Why Legacy Energy Group

Operational Excellence

Proven:

Execution across multiple states and project types

In-house Capabilities:

Development, engineering, EPC,

operations

Vendor Network:

Pre-qualified suppliers, contractors,

lenders

Regulatory Expertise:

Interconnection, permitting, compliance

Strategic Partnership

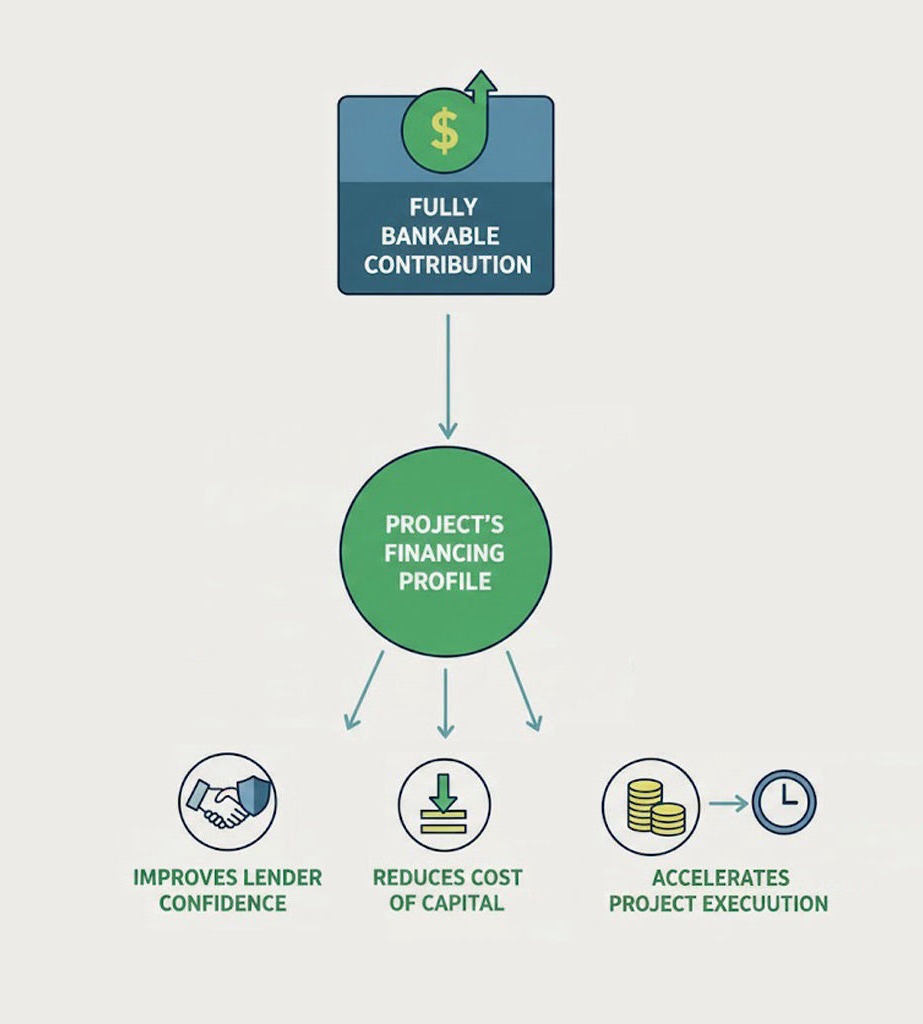

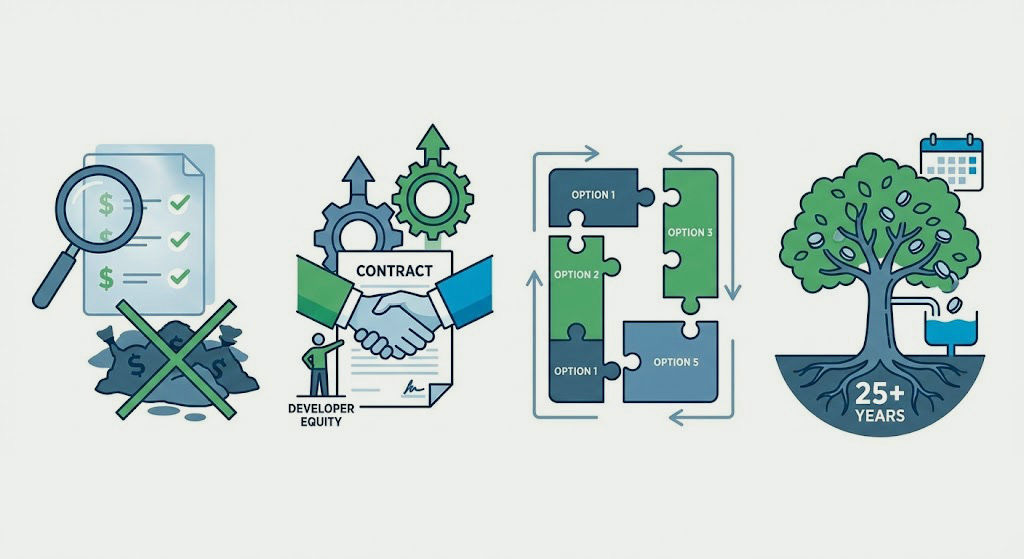

Transparent Economics:

No hidden fees or complex structures

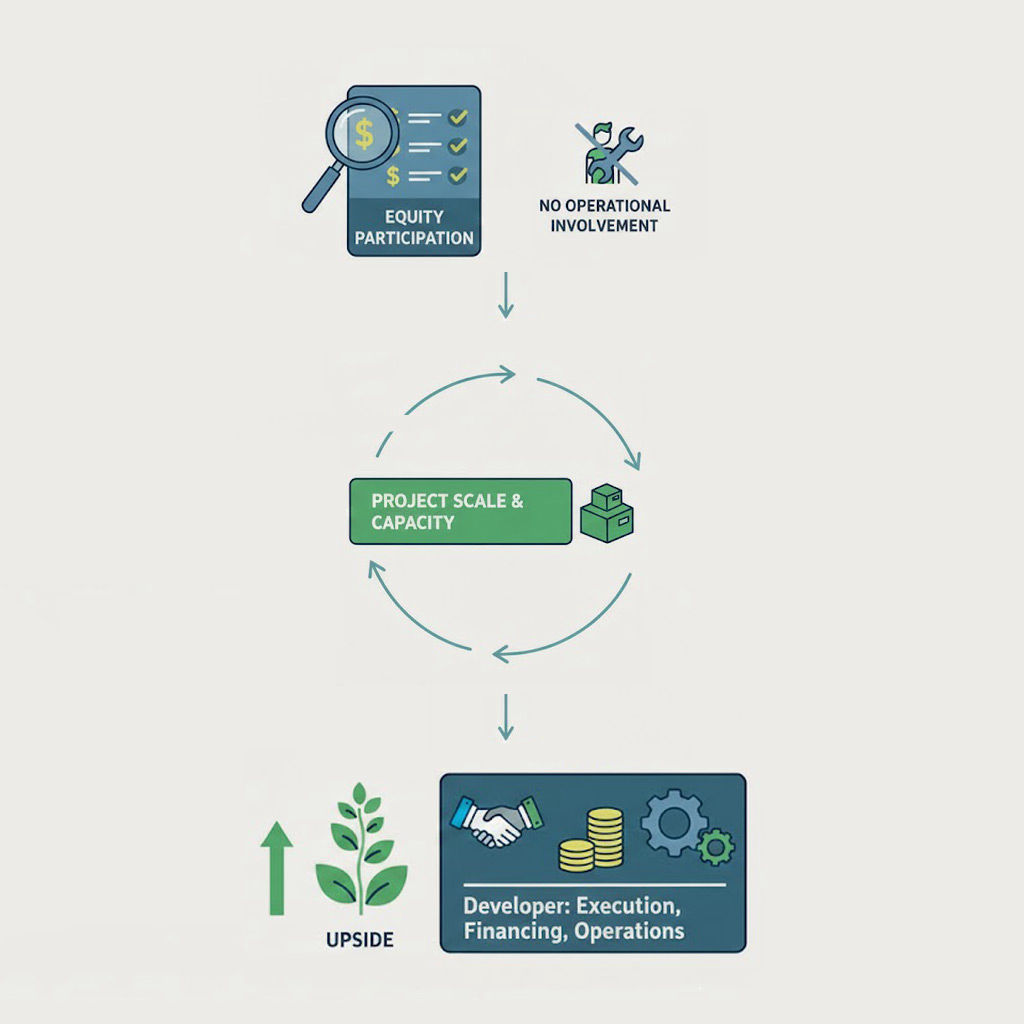

Aligned Incentives:

Developer equity ensures performance

commitment

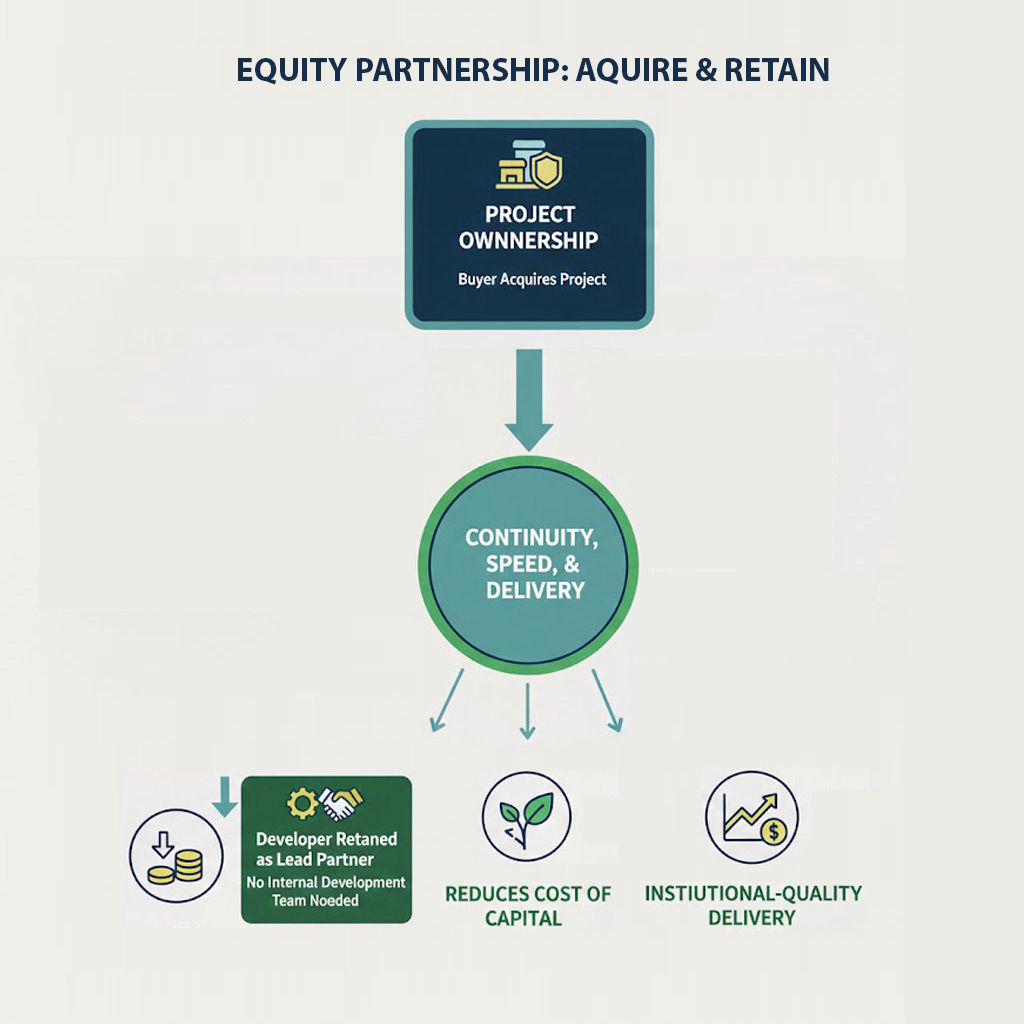

Flexible Structures:

Five options accommodate diverse partner

profiles

Long-tern Relationships

25+ year partnership with ongoing cash

flow

Risk Management

Professional Indemnification:

Developer covers project liabilities

Institutional-grade

Documentation:

Legal protections aligned with

infrastructure standards

Experienced Leadership:

Team with tens of megawatts deployed

track record

Financial Stability:

Multi-project portfolio de-risks project

viability

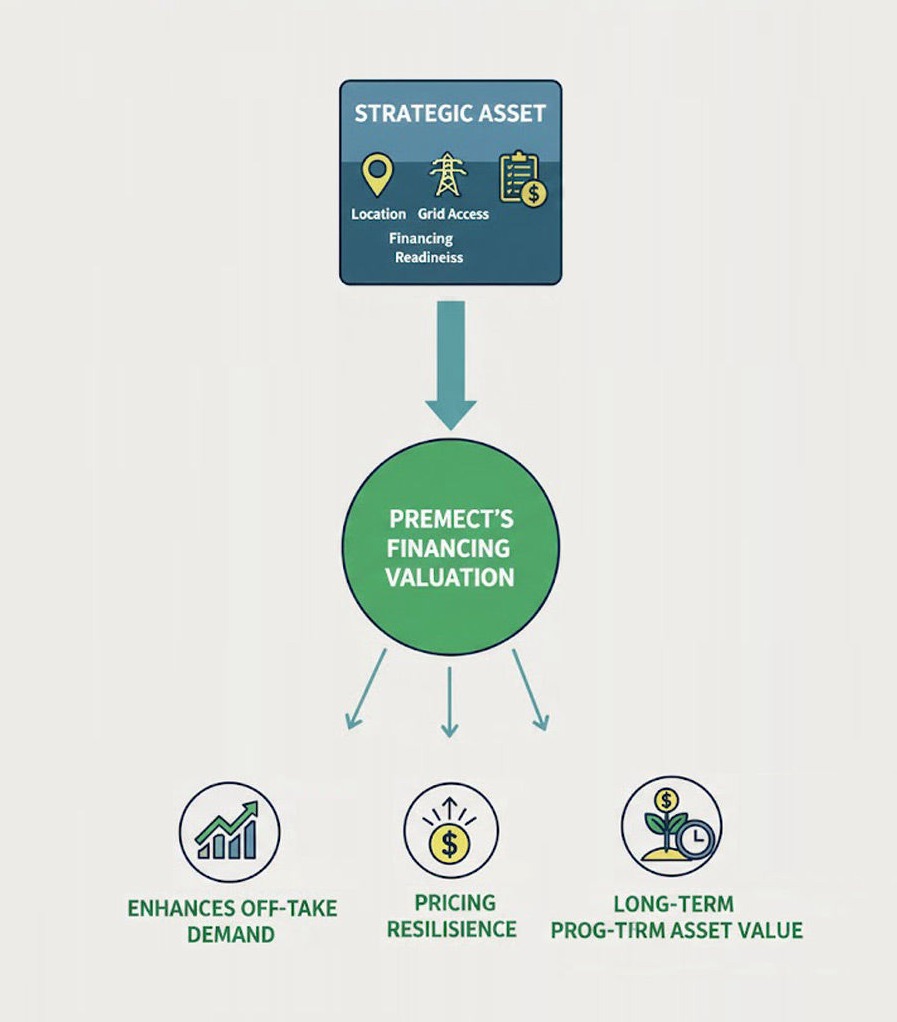

Market Position

Strategic Locations:

ERCOT and other high-growth markets

Strong Incentive Environment:

Federal ITC, state tax benefits, CRA

programs

Growing Demand:

+50% regional electricity demand growth

forecasts

ESG Alignment:

Mission-driven sustainable infrastructure

deployment